The Rise of the Retail Investor

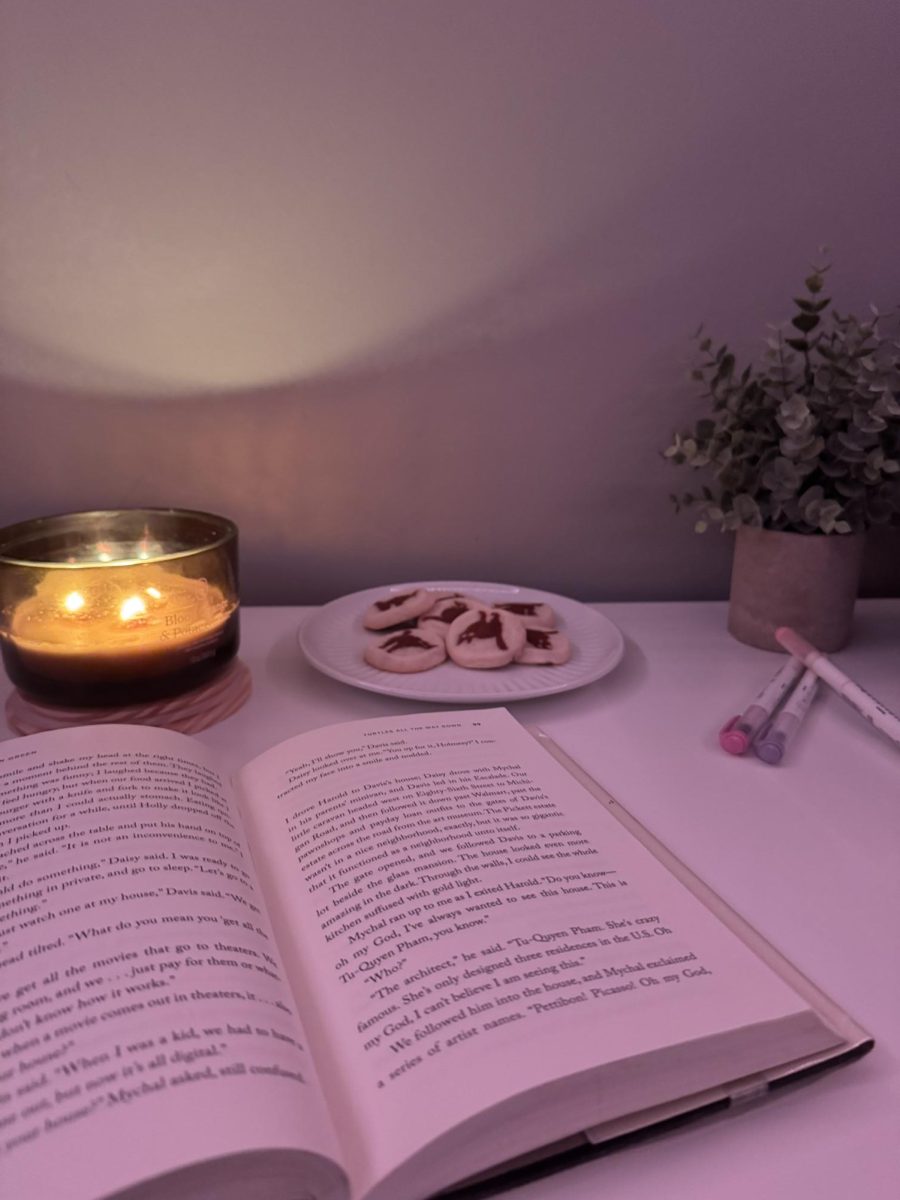

Investing has never been easier than now, and can be done right through the phone while going on a walk. Photo courtesy: Nate Wolfe.

May 31, 2021

Over the past few months, retail investors have seen large gains with “meme” stocks and cryptocurrencies like Gamestop and Dogecoin. A retail investor is an individual, non-professional investor who buys and sells securities. They are the everyday person investing through a brokerage or savings account.

This rise started in January, when the Reddit group known as Wall Street Bets pumped a group of struggling stocks that had no real reason to go up. One of these stocks was Gamestop (GME), which started at a $20 stock price in early January and peaked at $483, which is a 2,315% increase in only a couple of weeks. This increase is due to the Reddit group generating so much hype for the stock and getting more people to buy it, driving the share price up.

Cryptocurrencies have also been on the rise recently, and one that stands out from the rest is DogeCoin. This crypto was created in 2013 by a college student and now has a bigger market cap than most S&P 500 companies, at around $72 billion.

Even Elon Musk, one of the richest men in the world, has gotten into the craze. He has used his Twitter account to build hype around the crypto, even implying that Tesla will accept Doge as a payment option in the future. Senior Nik Cruciani said, “I first found out about Dogecoin when Elon Musk started tweeting about it back in February. Now I am currently up a couple thousand dollars from it.”

These “meme” stocks and cryptos can be very risky and are known as pump and dumps. This is a scheme to boost the price of a stock through recommendations based on false, misleading, or greatly exaggerated statements. These securities are very volatile and can crash just as fast as they rise.

Frank Balestriere, a business teacher at Foran, said that the biggest risk is, “when the craze ends and the actual value of Dogecoin and Gamestop is lower, potentially much lower than the levels they traded for during the craze.” These assets do not have any real value backing their prices other than the hype, and based on the past, these crazes eventually come to an end.

Balestriere continues, “following the herd is almost a certain way to lose money, particularly when the value of an asset is driven higher by the hype.” Everyone should do their own research before investing, because these assets are extremely risky and volatile.